Then, you subtract your Adjustments to Income, which includes Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account.

To work out this calculation you should add up all the elements that make up your Gross Income, which includes wages, dividends, capital gains, business income, retirement distributions and some other income. What is Adjusted Gross Income?Īt its simplest, Adjusted Gross Income (AGI) is gross income minus Adjustments to Income. MAGI can vary depending on the tax benefit. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans.

#Adjusted gross income on w2 how to#

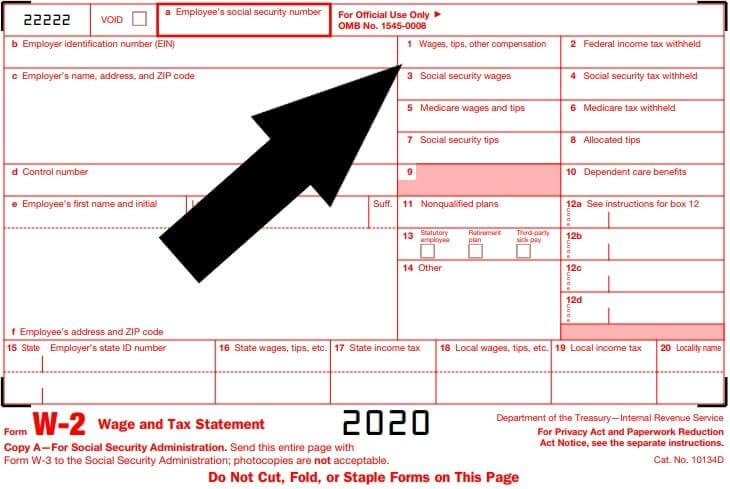

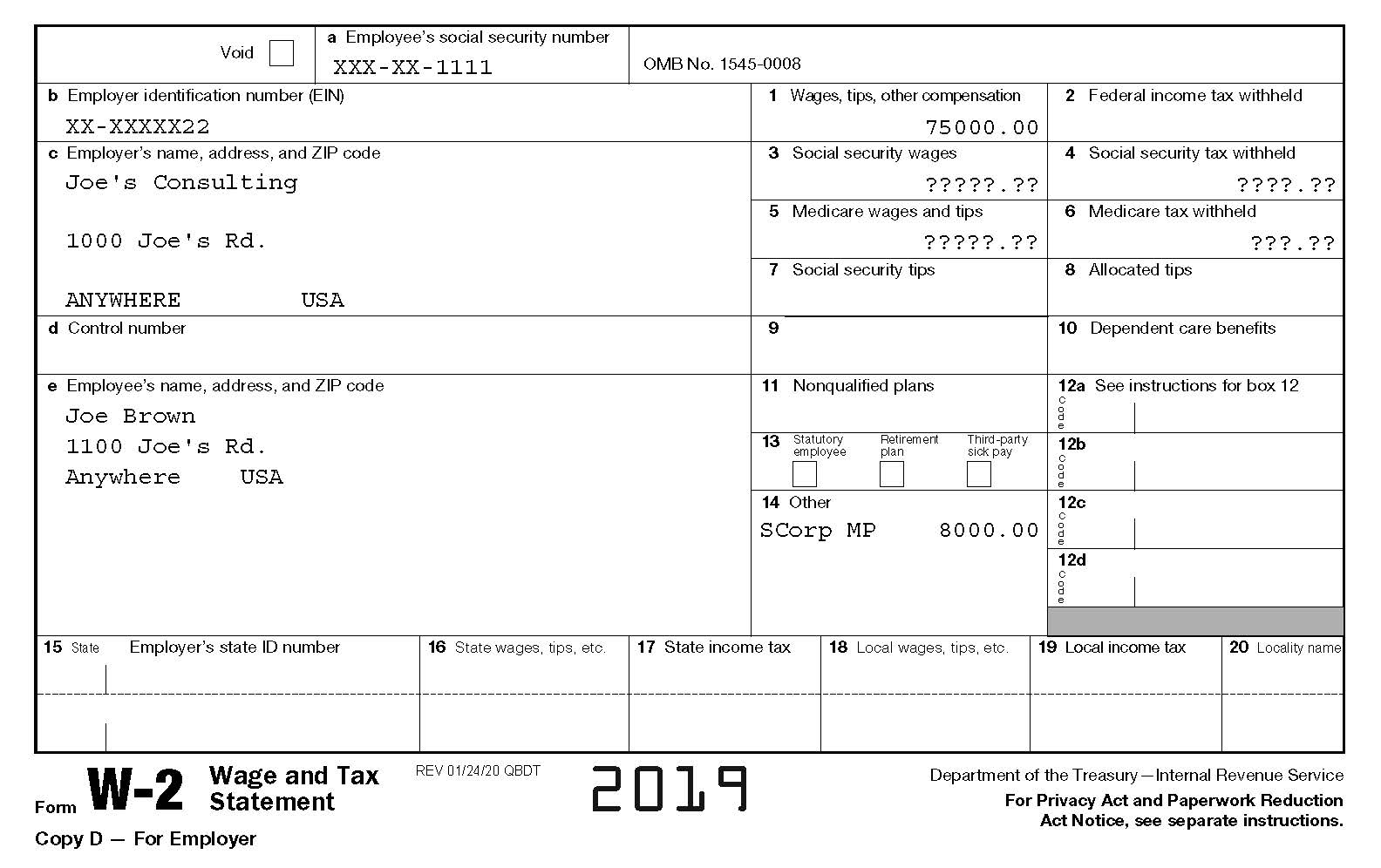

That's often the case with Adjusted Gross Income, so we're going to break down what exactly this is and how to find it through the W2 form. Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items like exempt or excluded income and certain deductions. Even if some of these terms are familiar, many have forgotten what they mean exactly. The amount in Box 1 will generally be the YTD Gross under the Summary section of your final earnings statement, minus any pre-tax deductions such as. If you receive the missing or corrected Form W-2 or Form 1099 after you file your return and a correction is needed, use Form 1040X (PDF), Amended U.S. (Although these forms may show your total income for the year, they dont include. You wont find last years AGI on: Your W-2 or 1099 form.

Assuming the two of you are filing together for the first time in 2021 (congratulations by the way), youll want to enter the adjusted gross income (AGI). As Americans take the time to file their tax returns for the 2021 tax year, many complex terms come up in that process. If you dont have your 2021 1040 or 1040NR.

0 kommentar(er)

0 kommentar(er)